- Our Insurance CoverOur Insurance Cover

We understand the individual nuances that come with insuring all types of listed property, in every part of the UK, so you can have complete confidence in our service.

- Our Insurance CoverOur Insurance Cover

We understand the individual nuances that come with insuring all types of listed property, in every part of the UK, so you can have complete confidence in our service.

- Listed Home InsuranceListed Home Insurance

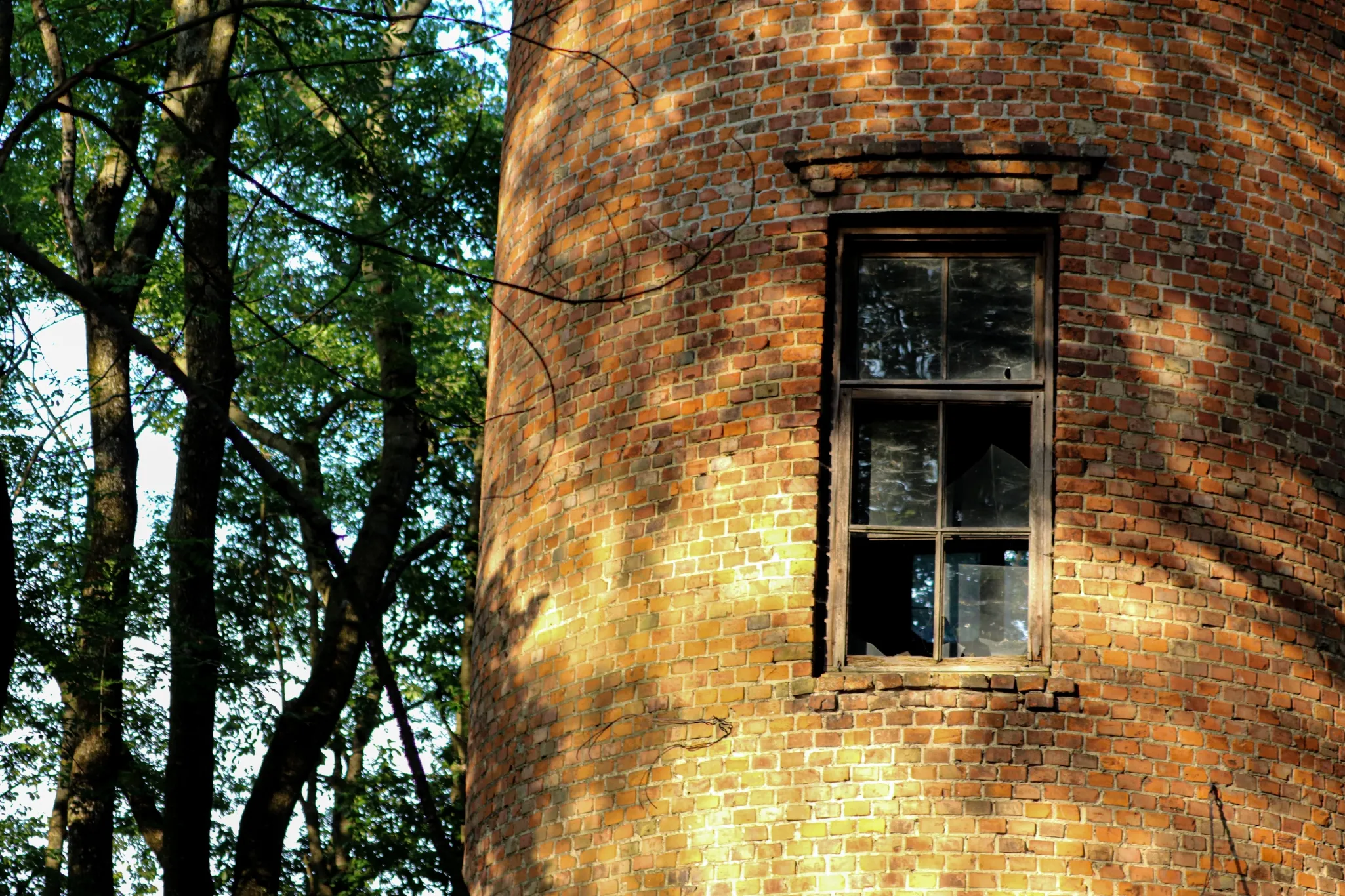

Listed properties are important to our heritage and there are laws on the changes you can make to help preserve your home’s unique character. Insuring your home is therefore more complex, but it is also absolutely vital.

- Listed Building InsuranceListed Building Insurance

From your core structure down to the finer details, such as non-standard locks and latches, we will help you find listed building insurance tailored to you.

- Listed Contents and Collectibles InsuranceListed Contents and Collectibles Insurance

Our listed building contents insurance is specially designed to give you the right level of protection for all your contents and collectibles.

- Listed Buildings and Contents InsuranceListed Buildings and Contents Insurance

Our team has the specialist knowledge to find you listed buildings and contents insurance that’s tailored to your needs.

- Contract works insuranceContract works insurance

At Abode Insurance, we understand the unique challenges and rewards of restoring historic properties.

- Listed Home Insurance in ScotlandListed Home Insurance in Scotland

Listed building insurance in Scotland can be complex. Abode are experts in the field and can help you find the right coverage today.

- Useful documents and policy wordingsUseful documents and policy wordings

Please find our policy wordings and IPIDs below.

- Our Insurance CoverOur Insurance Cover

- About UsAbout Us

Abode is dedicated entirely to finding insurance solutions for listed property owners, and over the last 15 years our friendly team of advisors have insured over 20,000 listed properties, from country estates to quaint country cottages, whatever the grade listing across the UK.

- About UsAbout Us

Abode is dedicated entirely to finding insurance solutions for listed property owners, and over the last 15 years our friendly team of advisors have insured over 20,000 listed properties, from country estates to quaint country cottages, whatever the grade listing across the UK.

- Our ReviewsOur Reviews

Find out what our clients have said about Abode on our trusted review platform Feefo.

- Meet the TeamMeet the Team

Meet the Abode Insurance team.

- Contact usContact us

Contact us

- About UsAbout Us

- Advice & FAQsAdvice & FAQs

Advice and FAQs

- Advice and FAQsAdvice and FAQs

Advice and FAQs

- Listed property owner’s glossaryListed property owner’s glossary

One of the hardest things about insurance is that it is almost always full of words and phrases not everyone is familiar with. At Abode, we want to make insuring your home as straightforward as possible, so we’ve put together a glossary of terms that you can refer to at any time. We’d recommend bookmarking this page so you can come back to it easily.

- Resource HubResource Hub

Here you can access our insights.

- Advice and FAQsAdvice and FAQs

- Claims SupportClaims Support

Our philosophy is based on placing our customers at the centre of our decision-making and ensuring that we treat you with empathy at all times. We strive to be responsive, proactive and always communicate in a clear, open and transparent way.

- Claims SupportClaims Support

Our philosophy is based on placing our customers at the centre of our decision-making and ensuring that we treat you with empathy at all times. We strive to be responsive, proactive and always communicate in a clear, open and transparent way.

- Making a ClaimMaking a Claim

We have a dedicated 24/7 helpline so if you need to call out of office hours, you can still reach someone who will advise you and notify us, so we can get back to you as soon as we can.

- Claims SupportClaims Support

- News & ViewsNews & Views

News & Views

- Ask for a quoteAsk for a quote

Ask for a quote

- Contact usContact us

Contact us